NKT

An appealing green growth story, but now overpriced

Danish company NKT makes and installs subsea HVDC cables (High Voltage Direct Current). NKT’s business model gets high ROICs (48% as of 2024). European governments are pledging to have built c500 GW of offshore renewable electricity capacity by 2050 – 14 times as much as there is presently. Each additional GW will need expensive high capacity subsea HVDC cables. NKT’s shares aren’t at an extravagant price, 24.7 P/E 2025E and a €5.2 BN market cap. However, despite appearances, NKT is not a buy. Even my optimistic DCF finds 24% downside. The rest of this article aims to explain and convince you of this, to avoid what might otherwise be a drag on your portfolio.

The Future Decades

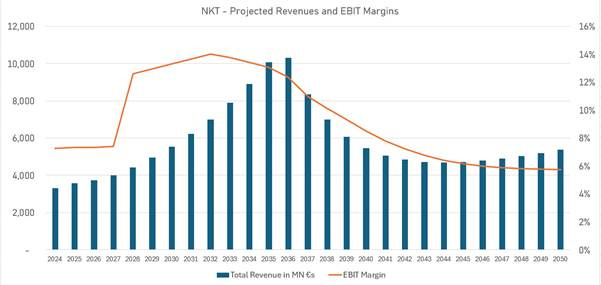

Here’s my optimistic but plausible story for NKT. By 2028 NKT will have worked through c70% of its order book (currently about €10bn) making and installing HVDC cables. EBIT margins in this their largest segment (the Solutions segment) will double as the higher priced deals that they signed c2023 hit the income statement. By 2030, the order backlog will remain healthy, albeit smaller as new deals have only replaced some of the current peak. HVDC projects are expensive and need to be planned so management knows to a high degree of probability what revenue and expenses will be until at least 2028. Triangulating management’s guidance on Capex, ROCE, and “organic revenue growth at standard commodity prices” I get a net income of c€400mn by 2028.

As is discussed in the long term Offshore Development Plan written by ENTSO-E (the organisation of European transmission operators), after 2028 European Governments will aim to build 100s more GW of offshore generation capacity, and hundreds of thousands of kms of HVDC cables to connect it. There’s reason to be sceptical that these ambitions will be realised. This will cost in the hundreds of billions of €s and European voters will have to be convinced to pay for it all, primarily through their utility bills. However, as I detailed in my previous post, according to credible polls done in 2023, most EU voters think that the damages of climate change would outweigh the costs of net zero (73%!) and only 5% thought that their government was currently doing too much on the issue. Assuming that the EU does achieve something like this investment plan is therefore an optimistic but plausible scenario for NKT.

Although NKT will benefit from this project, the growth will tail off and then reverse. On ENTSO-E’s projections, the GWs of offshore electricity generation capacity to be built per year in the period 2040-2050, will be half of what it was 2030-2040.

NKT is capital heavy. It currently has a 0% pay-out ratio and its high ROIC is buoyed by a negative working capital – prepayments for orders. That cash will soon be spent on the €2bn of capex they need to do 2025-2028. In my DCF I’ve assumed that after this investment cycle, NKT will be able to return to their 33% dividend pay-out policy. This ought to be enough to allow them to meet the demand growth to come. Making and laying these subsea HVDC cables requires expensive ships and factories. As the sales from installing these cables slows (in c10 years’ time) they could hike the pay-out ratio to 100%. However, as I’ll argue below, they will struggle to find a revenue stream to replace this huge build out.

I’m going to address the main objections to my bearish view. But before that I’m going to clarify a few basic questions. Additionally, paid subscribers will receive a transcript of my call with management, and the excel DCF model where I detail my projections and how I came to them.

Basic Questions

What are HVDC cables and what they useful for?

High voltage direct current cables are an efficient way of transporting electricity over long distances. Our modern electricity grids were built to use alternating current, where the current rapidly and repeatedly flips direction. Today we have the technology to use direct current for long distance cables, which reduces transmission losses relative to AC. If you want to learn more I thought that this video did a good job of explaining things to a non-expert like myself. What are HVDC cables used for? Primarily two things – linking up the grid to distant sources of renewable energy (hydro, offshore wind, solar etc) and connecting different grids. One difficulty with connecting different electric grids is that they often operate at different AC frequencies (roughly – the current changes direction a different number of times per second). The HVDC cable setup surmounts that difficulty by converting the AC to DC at one end of the cable, and then converting it back into AC, at the right frequency, for the receiving grid. Why would building a connection between two grids be profitable? Well, a HVDC between two electricity markets, with different spots of supply and demand allows for profitable arbitrages. There is 2-3 hours of difference between the sunrise in Portugal and that of Romania, for example. A better integrated grid would allow market participants to buy solar energy even at a time of day when the sunshine is weaker in their home country. Spain has more solar, the UK has more wind, and Sweden has more hydro. By maximising the interconnection between different European grids, we maximise our ability to dispatch intermittent renewable resources.

How has the financial performance of NKT been?

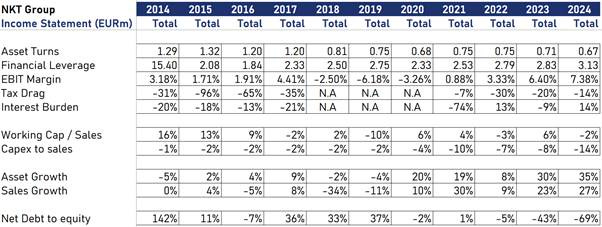

First thing to note is that NKT sold their vacuum brand, Nilfisk, in ’17 and their Photonics division in ’22. The period ’22 to ’24 (post-covid) is interesting. We see margins increase as we eject the photonics division and see higher growth in NKT’s highest margin Solutions segment (c75% of EBITDA in ’24) which makes and installs HVDC cables. Secondly we see financial leverage increase despite the company becoming increasingly net cash. Why? Because their notably large order book for HVDC installations have come with upfront payments, i.e. large contract liabilities. That the European Transmission Operators were willing to pay this is a sign of high demand for NKT’s HVDC installation services. It also suggests that NKT’s supply isn’t easily replicated. Thirdly we see record high capex to sales and asset growth. NKT are expanding all of their construction facilities in Europe and building a new cable laying ship.

How much of the business is exposed to HVDC cables?

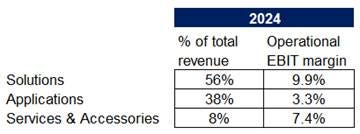

Solutions is their high voltage segment. As of 2024 most of its revenue is installing deep sea or underground HVDC cables. The Solutions segment provided 75% of 2024’s EBIT. NKT’s order book is currently roughly 50/50 interconnection HVDC projects (connecting different European grids) and offshore renewable HVDC projects (connecting offshore wind with homes on the grid where the power is used). Applications is the low to medium voltage cable business. It’s geared to European construction activity and thus doesn’t grow very much. Services and Accessories is mostly maintenance services, HVDC offshore cables play a large part there.

Does NKT really have a competitive advantage in making and install HVDC cables?

It is not obvious from NKT’s historical track record that it has a consistent competitive advantage.

However, as previously mentioned, NKT sold off two large businesses in 2017 and 2022 (Nilfisk and their photonics business). Although NKT was founded in 1891, they only purchased their current high voltage cable business (with the cable laying ship and two large factories) from ABB in 2017. The EU’s large offshore HVDC cable build out project is only just beginning. Before now NKT has had a competency without a gigantic source of demand.

To be specific NKT’s competitive advantages are –

1. NKT has the technological know-how to build high voltage direct current cables with sufficient insulation to run for 100s of kms deep underwater, conducting electricity at low losses and with such a low fault percentage such that they can be expected to last for 40 years. Admittedly there is competition. In Europe there is Nexans, and Prysmian. Sumitomo and LG are reportedly starting to invest in European HVDC factories. But outside of those companies with their technical understanding, there is no easy path for quickly converting capital into extra supply here.

2. Each HVDC project is unique and thus the cables need some redesign for each project. The features of the grid (or grids) they are connecting to, like for example the frequency of the AC, will affect the design. The depth and condition of the seabed will also affect the design. This means that the industry is less likely to over invest and create an excess of commoditised supply.

3. NKT has sufficient balance sheet strength. NKT has the cash on hand to guarantee that it will be able to grow supply to meet the demands of the contract. NKT’s cash position means that it can enter into robust hedging deals that will prove that it could handle commodity price fluctuations.

4. NKT has a growing track record of on time implementations of these HVDC projects.

5. The assets you need to manufacture and implement these cables take a while to build. NKT currently has one cable laying vessel – The Victoria with 11,000 tonnes of cable laying capacity. They ordered a new one in 2023 – The Eleonora with 23,000 tonnes of cable capacity. The Eleonora is expected to start working only in 2027.

Solar is cheaper – won’t the EU eventually bow to efficiency and cease this expensive offshore wind in favour of cheaper utility scale solar PV?

Solar indeed has a LCOE (levelised cost of electricity) lower than that of offshore wind (0.043 versus 0.079 USD/kWh globally in 2024 according to the IEA). But the EU’s various net zero plans are already taking account of this. Their offshore plan is to build c88 GW of capacity by 2030, whereas the EU’s Renew EU power plan envisages 600 GW of solar being built by 2030. Secondly, the wind blows over the sea at times when the sun doesn’t shine as much on land. Having electricity generation distributed over the day means that a higher % of it can be dispatched. Finally, even though the amortization of the price of the land is a low % of LCOE for solar, European governments are reticent to give out construction permits. For evidence on this point see the dismal state of infrastructure investment over the past decades in my home country the UK. There are far fewer nimbies in the Ocean than there are near to the, mostly, densely populated areas of mainland Europe.

As a bonus point, cheap PV solar might make offshore wind relatively less attractive, but it could enhance the prospect of building HVDC submarine cables across the Mediterranean to connect the European grids with cheap solar assets in North Africa. X-link, the UK’s proposed HVDC connection with Morocco has been cancelled. However, the ELMED HVDC connector between Italy and Tunisia is going ahead. Cheaper solar needn’t decrease the demand for HVDC cables. It might just relocate their destination south.

Counterarguments to my bearish conclusion

Won’t NKT find other sources of demand for HVDC cables after 2040?

This is difficult. Firstly, America is not a great source of demand for NKT as they don’t have much ocean in between their population centres, and they have a lot of remote land. They can thus use overhead HVDC cables. There the insulating work is simply done with the large air gap. Thus, the construction of such cables is easier and more commoditised. That isn’t a market that would suit NKT or their high margins. Like America, China lacks an ocean-y topography. Additionally, the Chinese market has a much lower required rate of return, thus NKT is unwilling to bid for business there. In fact, NKT exited China in 2016/2017. NKT needs large economies to support large electricity infrastructure projects, and the two best options outside of Europe are precluded.

Conceivably South-East Asia will see demand for large HVDC projects in the future, as long as there are no large political upsets that prevents countries from working together. There is even talk of linking Europe with North America, the NATO-L project. However, such demand would be far in the future, where required return rates sharply diminish how much we care. It will also require local factories to be built, which obviously reduces how much of that profit will reach the dividend.

What about when the cables need replacing?

HVDC cables have a lifespan of 40 years. A new cable today will need replacing in 2065. At a 20% profit margin, a 50% pay-out ratio and a 7% real required return rate– €1mn of revenue in 2065 is worth €6,678 today.

Oughtn’t we to assume super high margins during this build out, as governments push demand faster than the free market can keep up?

My DCF already assumes a peak of 19% EBIT margin for NKT, a company with an average 3% EBIT margin 2005-2024. If we assume margins go even higher than 19%, then this pushes up the cost of these offshore infrastructure projects, and it becomes even less credible that European governments will manage to convince voters to pay for it all. NKT does have some competitive advantages. But these are not insurmountable. Competitors exist and more will come if NKT looks set to make 4x the average ROIC for a decade.

Aren’t you being too pessimistic about the capital requirements – can’t they grow into European demand with a higher dividend pay-out?

Management guide to a cumulative 2bn required capex 2025 – 2028 and that margins will jump after that. If we assume that after that NKT’s customers are willing to pay both high margins and very high prepayments, sufficient to prepay for all the required capex, then NKT could keep a 100% pay-out ratio from 2028 onward. This turns my DCF from a 24% downside to a 16% upside, still insufficient to make me want to buy. Additionally, this is implausible. NKT’s management have suggested that these higher margins are the reward for their having reduced their working capital requirements on these deals. The Euro-zone has a shrinking population and an 88% government debt to GDP ratio (although the offshore build out is heavily weighted to the northern seas, where the governments tend to have lower debt). It isn’t plausible that these governments will be so generous with such large infrastructure projects.

The prime problem with the maths of this DCF, is that the construction revenues fall as the Net Zero project completes, and after that there aren’t any plausibly equivalent sources of demand for NKT’s subsea/underground HVDC cables.

Conclusion

The EU’s large subsea HVDC cable buildout plans will grab the headlines for NKT. However, even those ambitions are not enough of a future to value NKT at 24 P/E, when NKT makes its profits primarily during their construction and installation, and needs a low pay-out ratio to grow.

A few main ways in which my conclusion could be wrong occur to me. NKT could successfully build a business in South-East Asia and uncover another source of demand. Additionally, NKT could show that the economics of their business servicing HVDC cables is much better than what I’ve assumed in my DCF. Indeed, steady growth in their Services and Accessories Segment is what’s driving the growth in revenues that I’ve assumed in the back of the 2040s.

I wonder if the market might at some point reward NKT with an even higher multiple, as something like the growth trajectory I’ve projected out to 2036 occurs. If it does, I hope that you my wise reader will not be fooled and will avoid some underperformance.

To clarify - I have no personal stake in any security of NKT or of its competitors.

Below is the Google drive link where you can download my DCF model and the meeting transcript -